Heading into April, You Don't Have to Yell's editorial calendar was set to tackle the issue of taxes - a topic that seemed timely earlier this year. Then the city of Wuhan got everyone so sick that tax day was moved to July - the very month our Founding Fathers declared independence from England in a spat that started over taxation.

Best laid plans, huh?

Despite this, and despite the fact that both my guest and I were in the process of homeschooling our four respective children, Molly Michelmore, Professor of History at Washington and Lee University and author of "Tax and Spend : The Welfare State, Tax Politics and the Limits of American Liberalism", managed to connect with me to discuss the history of American taxation, and what we might glean from it as we look to pay for the $2 trillion check we just (proverbially) wrote.

Despite this, and despite the fact that both my guest and I were in the process of homeschooling our four respective children, Molly Michelmore, Professor of History at Washington and Lee University and author of "Tax and Spend : The Welfare State, Tax Politics and the Limits of American Liberalism", managed to connect with me to discuss the history of American taxation, and what we might glean from it as we look to pay for the $2 trillion check we just (proverbially) wrote.

You can listen to the full recording below, on Apple Podcasts, Spotify, or wherever you happen to get your podcasts.

Here's a quick summary of our episode:

World War 2 seems to be the closest historical parallel to where we are today

As with today's situation, World War 2 required a massive change in behavior on the part of the average American, along with the mobilization of America's industrial sector to defeat a truly existential threat. We also, coincidentally, had racked up historically high levels of debt in the decade prior.

While the debt to GDP ratio heading into World War 2 was around 50%, as compared with the approximately 100% it is today, fiscal conservatism was the norm for both parties, so taxes had to be raised to fund the war effort.

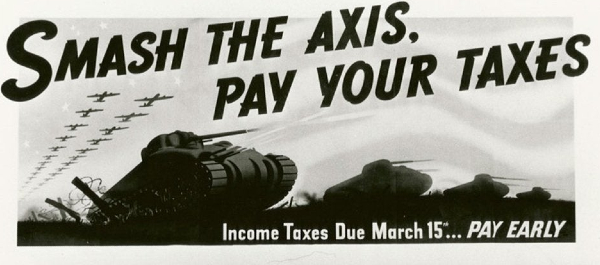

The Income Tax had some really good marketing

Prior to the war, the federal income tax only applied to 15% of the population, but was then expanded to cover 85% of American taxpayers. The fact Americans REALLY didn't like Hitler and Hirohito helped (it should be noted Mussolini will forever go down in history as the Art Garfunkel of the Axis), but there was also some fairly deft marketing on behalf of the federal government when this change went into effect - enlisting the help of fiscal luminaries such as Donald Duck to rouse public support.

Fiscal conservatism was then norm, until it was killed by ... Republicans?

After the war, the tax code remained unchanged throughout the 70s, which also saw a reduction in the debt to GDP ratio to a little over 30%. This changed in the 1970s, when the Republican Party realized the majority of Americans loved tax cuts and didn't care all that much about deficits - much like Americans love flat screen TVs and in-ground pools and don't care all that much about their savings account. While the goal of cutting taxes was to ultimately instill fiscal discipline by "starving the beast", said beast figured out how to sate itself by eating away at the future of our children, and the debt to GDP ratio has risen ever since.

We'll be diving more into the balance sheet of the United States later this month, but for now, you can hear the episode below.