For many Americans, the national debt is an item that poses serious concerns about the nation’s ability to fund its military, infrastructure, and social programs over the long term. To others, it’s like America’s obesity problem – sure, the number keeps going up and that’s probably not good, but hey – football!

To help provide some historical context we could all use to either calm our nerves or determine the best time to start looting, I asked David Thomson (pictured right), professor of history at Sacred Heart University and author of the book Bonds of War: The Evolution of Global Financial Markets in the Civil War Era on to this week's edition of You Don't Have to Yell.

The tall and short of America's debt situation is as follows:

- It's been worse.

- That's not a reason to celebrate.

The US National Debt Over Time

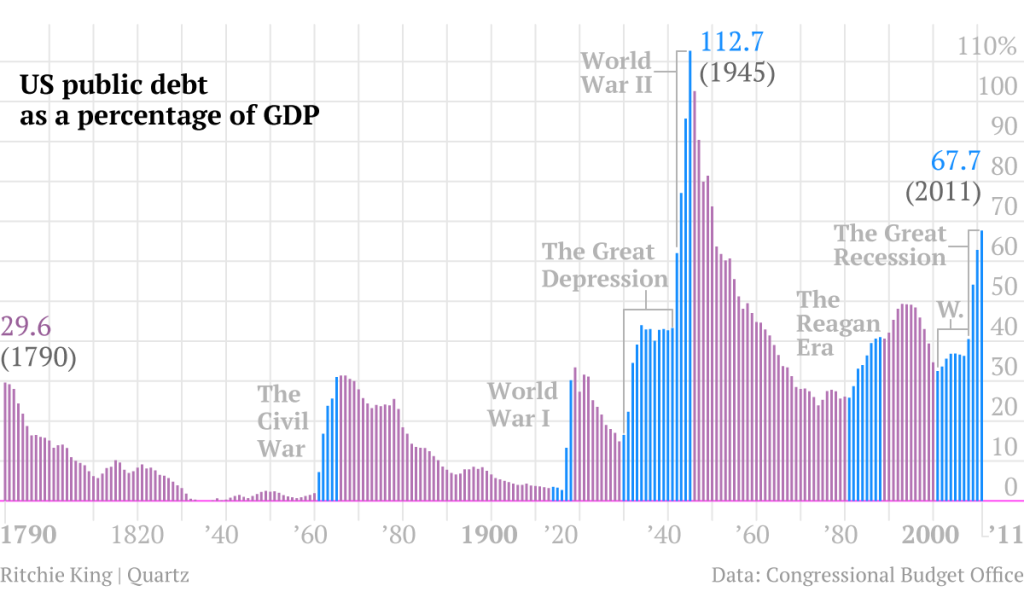

The chart above shows the US national debt as a percent of GDP since the nation's inception, which reveals America to be a nation literally born into debt. French and Dutch investors, eager to diversify their investments and put their money towards shooting at the British, funded much of the effort.

While the national debt steadily declined in the years that followed, states began accruing their own debt to fund infrastructure projects which they paid off by issuing more debt. This eventually resulted in a massive and predictable default by a number of states between 1837 and 1839, with over $100 million dollars in bonds being rendered worthless in foreign markets.

This did long term damage to America's creditworthiness until the Civil War, when foreign investors made the puzzling decision to being reinvesting in the United States just as it was coming apart at the seams.

The trend of debt being primarily a mechanism to fund wars continued up until the Great Depression, when the country saw a massive increase in government involvement in the economy with FDR's New Deal. This trend would continue through World War 2, reaching a high of 110% debt-to-GDP, and never cross below the 25% mark going forward.

Conclusions

The debate over debt carried by the US federal government is as much a questions as to how much we want the government to do for us, as it is a question of pure finance. The low levels of debt to GDP experienced in the first half of this country's existence were due, in part, to the fact that the US federal government didn't do all that much for your average citizen.

While that might lead some of us to opine for the good old days when we only spent what we earned, keep in mind high levels of federal spending put a man on the moon, built an interstate highway system many of us use on a daily basis, and funded the inception of the internet. There's certainly an argument for cutting government waste, but a US government operating entirely in the black seems unlikely.

There certainly is an argument to be made on the role taxes can play in managing debt levels, as the steep decline in debt we saw after World War 2 came with a large increase in tax rates for the most wealthy Americans. While some amount of debt can fund future economic growth, the 1830s taught us too much can render it worthless - meaning you can either have money taken out of your check in the form of taxes, or inflation.

Listen to the episode below, on Apple Podcasts, Spotify, Libsyn, or wherever your bad self gets your podcasts.